Real Estate Tax Rate In Wisconsin . here are the typical tax rates for a home in wisconsin, based on the typical home value of $312,369. our wisconsin property tax calculator can estimate your property taxes based on similar properties, and show you how your. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Compare your rate to the wisconsin and u.s. Sign up for email updates. equalized values are used for apportioning county property taxes, public school taxes, vocational school taxes and for distributing property tax relief. 73 rows wisconsin : Median property tax is $3,007.00. This interactive table ranks wisconsin's counties by median property. Property tax credit allowed for veterans and surviving spouses. gross property taxes levied in 2020 for collection in 2021 totaled $12.07 billion, by far the largest tax in the state.

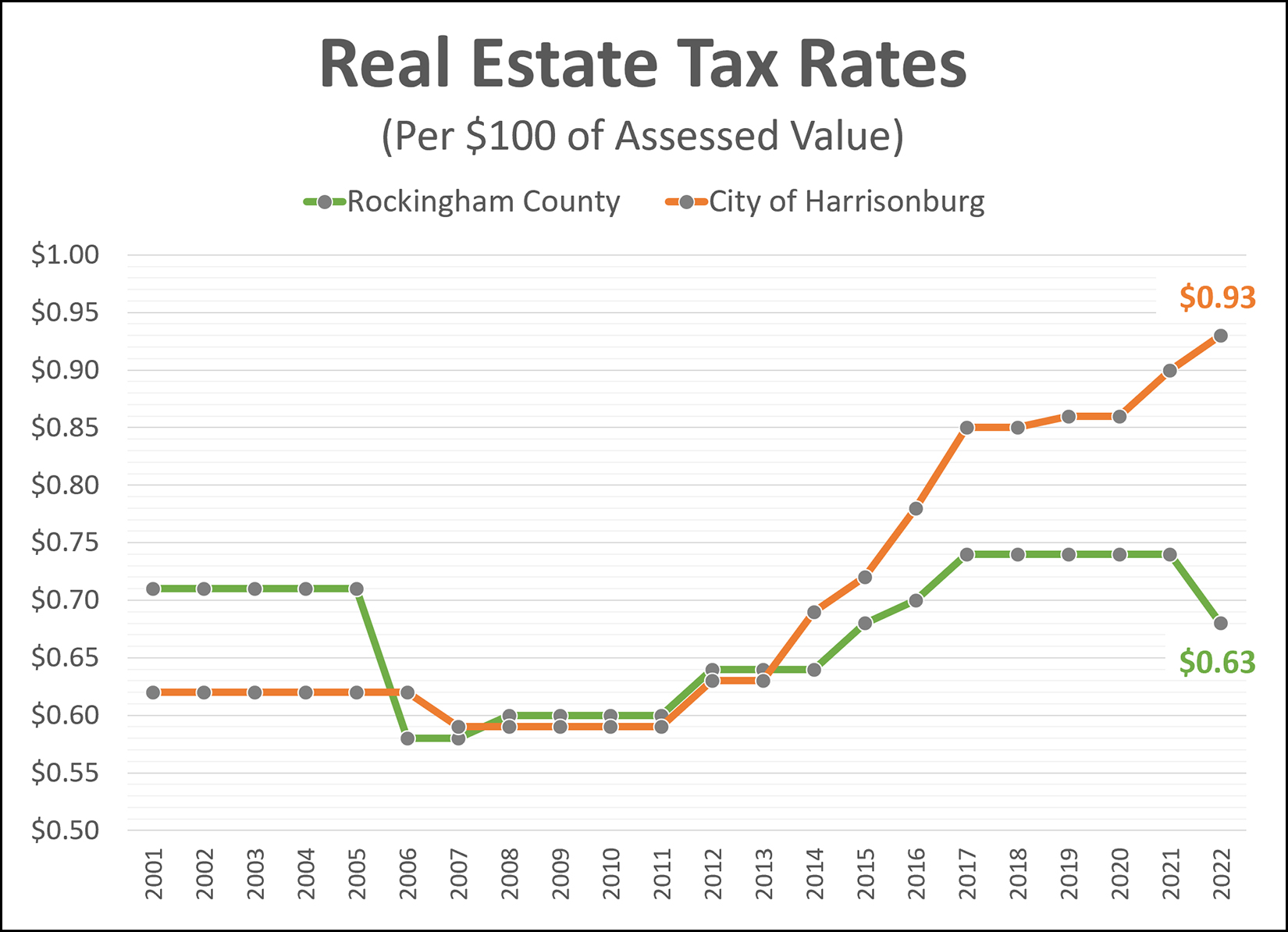

from www.harrisonburghousingtoday.com

here are the typical tax rates for a home in wisconsin, based on the typical home value of $312,369. Median property tax is $3,007.00. our wisconsin property tax calculator can estimate your property taxes based on similar properties, and show you how your. equalized values are used for apportioning county property taxes, public school taxes, vocational school taxes and for distributing property tax relief. Property tax credit allowed for veterans and surviving spouses. 73 rows wisconsin : gross property taxes levied in 2020 for collection in 2021 totaled $12.07 billion, by far the largest tax in the state. Compare your rate to the wisconsin and u.s. This interactive table ranks wisconsin's counties by median property. calculate how much you'll pay in property taxes on your home, given your location and assessed home value.

Assessments Market Updates, Analysis

Real Estate Tax Rate In Wisconsin This interactive table ranks wisconsin's counties by median property. gross property taxes levied in 2020 for collection in 2021 totaled $12.07 billion, by far the largest tax in the state. Compare your rate to the wisconsin and u.s. equalized values are used for apportioning county property taxes, public school taxes, vocational school taxes and for distributing property tax relief. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Sign up for email updates. Property tax credit allowed for veterans and surviving spouses. Median property tax is $3,007.00. our wisconsin property tax calculator can estimate your property taxes based on similar properties, and show you how your. here are the typical tax rates for a home in wisconsin, based on the typical home value of $312,369. This interactive table ranks wisconsin's counties by median property. 73 rows wisconsin :

From dxobnbzak.blob.core.windows.net

Wi Property Tax Rate at Trevor Smith blog Real Estate Tax Rate In Wisconsin calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Sign up for email updates. Property tax credit allowed for veterans and surviving spouses. here are the typical tax rates for a home in wisconsin, based on the typical home value of $312,369. our wisconsin property tax calculator can. Real Estate Tax Rate In Wisconsin.

From patch.com

Wisconsin's Property Tax Relief Bill in 3 Pictures Hudson, WI Patch Real Estate Tax Rate In Wisconsin our wisconsin property tax calculator can estimate your property taxes based on similar properties, and show you how your. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Property tax credit allowed for veterans and surviving spouses. Median property tax is $3,007.00. Compare your rate to the wisconsin and. Real Estate Tax Rate In Wisconsin.

From www.newsncr.com

These States Have the Highest Property Tax Rates Real Estate Tax Rate In Wisconsin here are the typical tax rates for a home in wisconsin, based on the typical home value of $312,369. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Median property tax is $3,007.00. our wisconsin property tax calculator can estimate your property taxes based on similar properties, and. Real Estate Tax Rate In Wisconsin.

From taxfoundation.org

How Does Your State Rank on Property Taxes? 2019 State Rankings Real Estate Tax Rate In Wisconsin Sign up for email updates. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. This interactive table ranks wisconsin's counties by median property. equalized values are used for apportioning county property taxes, public school taxes, vocational school taxes and for distributing property tax relief. here are the typical. Real Estate Tax Rate In Wisconsin.

From alineqrebecka.pages.dev

When Are Property Taxes Due In Wisconsin 2024 Jami Rhiamon Real Estate Tax Rate In Wisconsin calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Sign up for email updates. Median property tax is $3,007.00. here are the typical tax rates for a home in wisconsin, based on the typical home value of $312,369. Compare your rate to the wisconsin and u.s. gross property. Real Estate Tax Rate In Wisconsin.

From wispolicyforum.org

Wisconsin Policy Forum Navigating the Property Tax Real Estate Tax Rate In Wisconsin gross property taxes levied in 2020 for collection in 2021 totaled $12.07 billion, by far the largest tax in the state. Compare your rate to the wisconsin and u.s. equalized values are used for apportioning county property taxes, public school taxes, vocational school taxes and for distributing property tax relief. our wisconsin property tax calculator can estimate. Real Estate Tax Rate In Wisconsin.

From taxfoundation.org

Does Your State Have an Estate Tax or Inheritance Tax? Tax Foundation Real Estate Tax Rate In Wisconsin Sign up for email updates. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Property tax credit allowed for veterans and surviving spouses. gross property taxes levied in 2020 for collection in 2021 totaled $12.07 billion, by far the largest tax in the state. 73 rows wisconsin :. Real Estate Tax Rate In Wisconsin.

From brokeasshome.com

wisconsin tax tables Real Estate Tax Rate In Wisconsin equalized values are used for apportioning county property taxes, public school taxes, vocational school taxes and for distributing property tax relief. This interactive table ranks wisconsin's counties by median property. gross property taxes levied in 2020 for collection in 2021 totaled $12.07 billion, by far the largest tax in the state. our wisconsin property tax calculator can. Real Estate Tax Rate In Wisconsin.

From exonekpvy.blob.core.windows.net

Wisconsin Sales Tax Number at Sean Ahearn blog Real Estate Tax Rate In Wisconsin equalized values are used for apportioning county property taxes, public school taxes, vocational school taxes and for distributing property tax relief. 73 rows wisconsin : This interactive table ranks wisconsin's counties by median property. Property tax credit allowed for veterans and surviving spouses. our wisconsin property tax calculator can estimate your property taxes based on similar properties,. Real Estate Tax Rate In Wisconsin.

From fnrpusa.com

How to Estimate Commercial Real Estate Property Taxes FNRP Real Estate Tax Rate In Wisconsin our wisconsin property tax calculator can estimate your property taxes based on similar properties, and show you how your. Median property tax is $3,007.00. here are the typical tax rates for a home in wisconsin, based on the typical home value of $312,369. 73 rows wisconsin : Compare your rate to the wisconsin and u.s. Sign up. Real Estate Tax Rate In Wisconsin.

From taxfoundation.org

State Individual Tax Rates and Brackets Tax Foundation Real Estate Tax Rate In Wisconsin calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Compare your rate to the wisconsin and u.s. Median property tax is $3,007.00. Property tax credit allowed for veterans and surviving spouses. This interactive table ranks wisconsin's counties by median property. equalized values are used for apportioning county property taxes,. Real Estate Tax Rate In Wisconsin.

From wallethub.com

Property Taxes by State Real Estate Tax Rate In Wisconsin our wisconsin property tax calculator can estimate your property taxes based on similar properties, and show you how your. This interactive table ranks wisconsin's counties by median property. here are the typical tax rates for a home in wisconsin, based on the typical home value of $312,369. Property tax credit allowed for veterans and surviving spouses. Compare your. Real Estate Tax Rate In Wisconsin.

From taxfoundation.org

Ranking Property Taxes by State Property Tax Ranking Tax Foundation Real Estate Tax Rate In Wisconsin here are the typical tax rates for a home in wisconsin, based on the typical home value of $312,369. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. equalized values are used for apportioning county property taxes, public school taxes, vocational school taxes and for distributing property tax. Real Estate Tax Rate In Wisconsin.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Real Estate Tax Rate In Wisconsin Sign up for email updates. Property tax credit allowed for veterans and surviving spouses. Median property tax is $3,007.00. here are the typical tax rates for a home in wisconsin, based on the typical home value of $312,369. This interactive table ranks wisconsin's counties by median property. our wisconsin property tax calculator can estimate your property taxes based. Real Estate Tax Rate In Wisconsin.

From www.accountingtoday.com

20 states with the highest realestate property taxes Accounting Today Real Estate Tax Rate In Wisconsin Compare your rate to the wisconsin and u.s. our wisconsin property tax calculator can estimate your property taxes based on similar properties, and show you how your. 73 rows wisconsin : here are the typical tax rates for a home in wisconsin, based on the typical home value of $312,369. Sign up for email updates. calculate. Real Estate Tax Rate In Wisconsin.

From taxfoundation.org

Property Taxes Per Capita State and Local Property Tax Collections Real Estate Tax Rate In Wisconsin Compare your rate to the wisconsin and u.s. our wisconsin property tax calculator can estimate your property taxes based on similar properties, and show you how your. This interactive table ranks wisconsin's counties by median property. 73 rows wisconsin : Property tax credit allowed for veterans and surviving spouses. here are the typical tax rates for a. Real Estate Tax Rate In Wisconsin.

From www.armstrongeconomics.com

US Property Tax Comparison By State Armstrong Economics Real Estate Tax Rate In Wisconsin here are the typical tax rates for a home in wisconsin, based on the typical home value of $312,369. 73 rows wisconsin : calculate how much you'll pay in property taxes on your home, given your location and assessed home value. our wisconsin property tax calculator can estimate your property taxes based on similar properties, and. Real Estate Tax Rate In Wisconsin.

From realestateinvestingtoday.com

How Much Are You Paying in Property Taxes? Real Estate Investing Today Real Estate Tax Rate In Wisconsin 73 rows wisconsin : Median property tax is $3,007.00. equalized values are used for apportioning county property taxes, public school taxes, vocational school taxes and for distributing property tax relief. gross property taxes levied in 2020 for collection in 2021 totaled $12.07 billion, by far the largest tax in the state. Compare your rate to the wisconsin. Real Estate Tax Rate In Wisconsin.